1. EXECUTIVE SUMMARY:

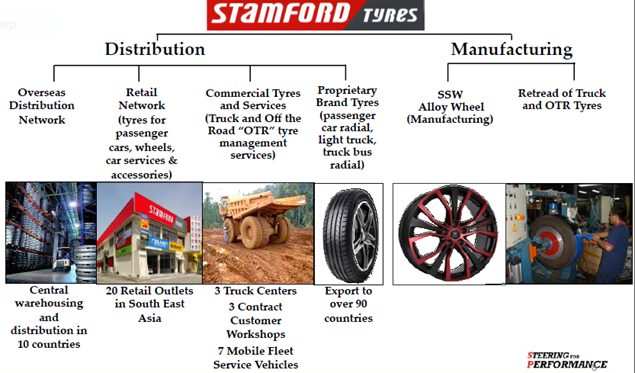

The Stamford tyre is a well-known tyre company which was established in the year 1930 in Singapore, Stamford road. From being a petrol service station cum a tyre retailer it has changed into a leading distributor of tyre and wheels with value-added services in 9 countries. Their major business is to distribute wholesale and retail branded tyres and wheels. Other secondary businesses are vehicle services, manufacture of aluminum alloy wheels, tyre remolding and manufacturing of proprietary brand tyres on the basis of a contract. Some brands innovated by them are Sumo Firenza, Sumo tyres and Stamford Sports Wheels. It’s also a leading player in fleet tyre management.

This company was listed in SGX-Sesdaq in the year 1991 and upgraded to SGX-ST in April 2003. They have retail outlets in alliance with Mega marts and tyre marts in Singapore and Malaysia.75% of the company’s total revenue is contributed by South-East Asia. It is an investment holding company with limited liability.

2. OBJECTIVE:

In this report, we have analyzed how Stamford tyres are being benefited by trading internationally, the measures it takes to manage various operational challenges, hedging methods practiced and various strategies followed to uphold it’s financial/investing decisions that would aid its international business operations.

3. INTERNATIONAL TRADE & ITS BENEFITS:

Tyre was invented 124 years ago. Tyre has become part and parcel of our life. The demand for vehicles keeps increasing throughout the world, so there is a need for tyre and wheel manufacturing companies to go global and satisfy the needs of the vehicle manufacturers. There are around 455 tyre factories around the world manufacturing around 1 billion tyres annually. Stamford tyres in order to be a market leader perform a lot of market research to find out what the customer wants and understand them better. They grow along with the market to provide better product offerings, design and concepts. They focus on quality rather than price (Tyres, 2014).

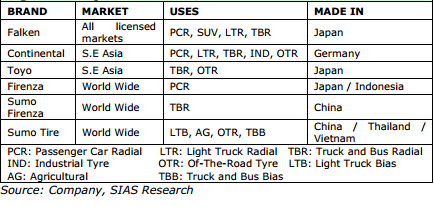

Stamford tyres having experience of over fifty years in the distribution of tyres and wheels decided to trade internationally to increase its revenue and brand image. To be on the safer side the Stamford tyre entered the new market through exports, the primary mode of entry Invalid source specified. By exporting the internationally branded tyres, they then gradually built a good trade relationship between the countries they traded-in. Knowing the strengths of the local market the Stamford tyres entered as a green investment entry. They opened their own manufacturing and distributive network units in 9 countries throughout Asia Pacific, Africa, Australia and India. During the expansion, the company mainly focused on brand building. Their latest expansion was in India to meet the booming market which thrives to be the sixth-largest market in the production of passenger vehicles (Financial report, 2013).

The company trades globally to increase its sales and thereby increase its revenue. Since it was started in 1930 it had immense knowledge about the industry so they started expanding. Holding a reputable position in the home country enabled them to go to other markets. This also increased its value in the home country. The potential advantage of it was the higher profit it rendered at the cost of higher risk.

The main advantage of the Stamford tyre in going global is the diversification of its risk. Increased diversification offsets economic slumps or recessions. If the business in one country is being affected by natural calamity or any other reason, the company may experience a negative fluctuation in the profitability of the company. But that can’t affect the whole business; it can be compensated by the profit earned from different countries. This leads to a healthy balance in the company’s profitability. In 2008 the demand for tyres in Chinese markets increased but eventually in the following years it began to decline so as an alternative they went for Vietnam and Thailand market. They have even set up a manufacturing plant in Thailand to promote their business. With the help of the experienced mining contractors and service engineers, they are planning to attract more contracts for truck and earthmover tyres.

They produce Stamford sports wheels in their plant in Thailand. From their manufacturing unit, they have innovated the earthmover Sumo tyres which have a rim diameter of 57inches that can be used for bigger trucks operating in Australia and South Africa. In 2004 they joined hands with the Singapore Institute of manufacturing technology (SIM Tech). The main objective of this collaboration was to gain knowledge and expertise in manufacturing process technology (Tyres, 2014). At present, the company is working with Dunlop technology to know what kind of tyre will suit the kind of road people travel in. This is to satisfy customers and provide them better safety, handling, fuel economy and longevity (Dunlop, 2014). Customers faced some problems in purchasing tyre and tube separately. So the R&D of Stamford tyre is working upon the “tubeless tyre technology” to make its global customers happy.

To attract investors, the Singapore government provides various tax benefits. Stamford another advantage from the financial point of view is that the company is operating in 9 countries so the company enjoys tax benefits in Singapore as this company pays taxes in other country link china, India and etc. They had a good reputation and loyal customers in the local market they were prevailing in, their objective was to satisfy customers throughout the world based on their needs and to become one of the top customers recognized brand in the world economy (Tyres, 2014). For example, they started distributing Falken tyres only because of the increased popularity of Japanese cars in South East Asia.

4. OPERATIONAL HAZARDS & HEDGING INSTRUMENT:

Stamford tyres face various challenges while performing its operations across various countries around the globe. Few of the operational hazards faced by the company are as follows:

1) Depreciation of South-African Rand:

Though the market potential in South Africa was good and the sales rate of tyres increased by 10 % in the FY 2012, there was a significant loss to the company’s profit due to the depreciation of the South African rand by 15% against the home currency Singapore dollars. These fluctuations in the Rand value resulted in decreasing revenue from S$38.3 to S$33.4 million dollars.

Stamford tyres obtained only 1/5th of its finance from the South African bank (in Rand) and the rest was in Singapore dollars. To reduce the impact of the foreign exchange Stamford should borrow more from local South African banks. In order to secure more finance from the local bank Stamford tyres are planning to do a long-term investment by increasing the investment in equity in South Africa. They have also relocated one of the top executives to South Africa from Singapore to resolve this issue and get better results (Financial report, 2013).

2) Increasing rubber price:

In the FY2012 there was a decline in the gross profit margin by 1.2% even though Stamford tyres were benefited by the increasing tyre price. This was due to the increase in rubber prices by 50% in FY2011. This was diluted by sales of products obtained at low prices in the FY2011 and by the value-added services provided by the Stamford tyres (Financial report, 2012).

3) Managing Inventories :

Due to the increase in the inventory level, the rental lease of the company increased to S$6.7 million. Moreover, the price for the major industrial space in Singapore is skyrocketing, resulting in reduced cash equivalent. As a measure, management has reduced the salary of the employees, cut their incentives and are disposing of slow-moving inventories (Financial report, 2012).

4) European Sovereign debt crisis :

Due to the European sovereign debt crisis, the European countries faced inflation and the demand for the proprietary tyre and wheels decreased dramatically. So the export of Stamford tyres was affected. In order to compensate for this loss, they started emphasizing their business in Southeast Asia (Financial report, 2013).

5) Natural Calamity :

In Thailand which is one of the major markets that contributes to about 9% of sales and where SSW are being manufactured, the operational and sales units were disrupted due to severe floods. This created difficulties in the distribution network. Stamford tyres have taken insurance cover for all the warehouses and inventories as a preventive measure to claim for their loss, in case of any future natural disaster (Financial report, 2012).

6) Product liability claim :

Due to defectiveness in the products the customers claimed for reimbursement, this not only increased the expense but also shake the company’s reputation. The company has taken measures to test its products before the sales (Financial report, 2013).

7) Low Supplier power :

Stamford tyres have a good relationship with suppliers and they have secured exclusive distribution rights from certain suppliers but there is no assurance that the supplier will continue to provide the distribution rights to the supplier in the future also. In case of any future discrepancies, the company might lose its distribution rights and this may have adverse financial implications. So as a precaution the company is giving more attention to building its own range of proprietary “in-house brands” (Financial report, 2013).

HEDGING METHOD ADOPTED:

As a hedging technique, Stamford has “increased local bank borrowings and equity to reduce the foreign currency-denominated payables.”Hedging instruments used are “forward currency contracts and interest rate swaps” (Financial report, 2013).

5. FINANCING AND INVESTING STRATEGIES:

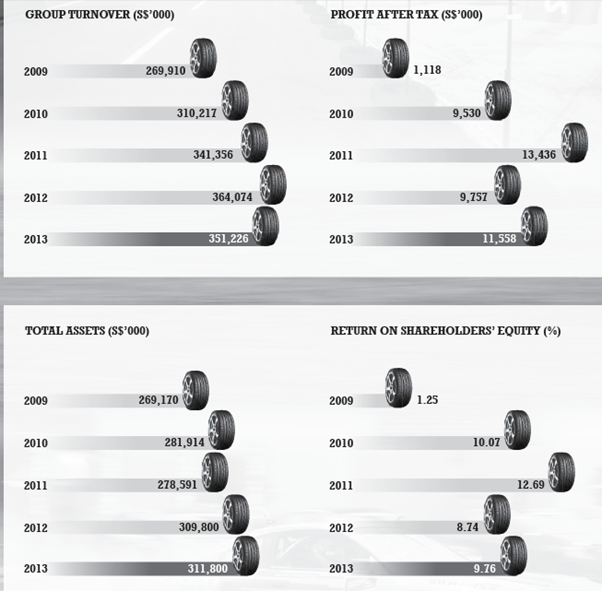

Basically, Stamford tyre is an investment holding company with limited liability. The profit after the tax is 11.5 million S$ in 2013. In FY2013, the cash equivalents (S$32.7 million) of the company was almost doubled when compared with the FY2012. The operations cash flow improved to S$18.3 million by adopting the new strategy of downsizing its inventories and optimizing the product mix. The inflow of cash from investing activities increased to S$12.2 million due to effective sales in China.

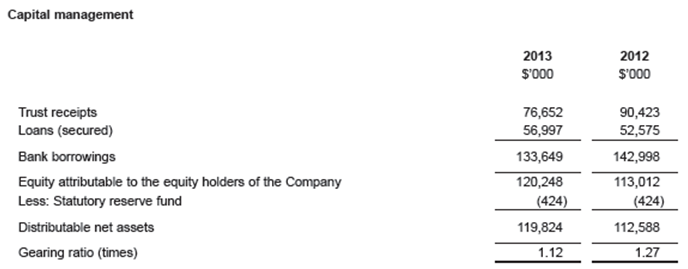

The net asset has increased from S$113.0 to S$120.2 million dollars; there was a shrink in the trade receivables and trust receipts from S$110.5 to S$101.3 million dollars. This shows that the company is expanding and is performing well.

The company’s trade payables have increased in the FY2013 when compared to 2012 as the company is delaying payment of the cash payable for the inventories obtained. And the company is not holding too much cash in hand also they are depositing cash at hand in the bank and are getting interest of 0.03–4.43% for the cash they have. This also increases their revenue. The company is working with five different currencies for its international operations to maximize the advantage from arbitration, by opting for loans in the currency with less interest rate.

The trade receivables of the company have been decreased 95.6 to 91.7 million S$ this shows that the company is managing its operations unit well as it has ensured that the customers make their payments for the services and the products rendered to them at the right time. They watch out for creditworthy customers. They keep records of their debt maturity dates, operating cash flows and various other credit facilities and ensure that all the payments are made without any delay. They also gather sufficient amounts from the bank, trade receipts, loans and hire-purchase contracts as funding. These loans are pledged over the assets so they must be paid back on time.

Stamford is a low geared company. The main debts of the company are in the form of long-term, short-term loans and trade receipts. The gearing also decreased to 0.85 from 1.13 in the FY2013 due to the new strategy of reducing the inventory levels. Owner’s Equity has increased to 69.3 to 58.0 million S$. This shows that the company is borrowing less and is using more of its capital for its expansion. They are also paying their short term debts properly. They have high creditworthiness so they can borrow money from any bank if necessary.

Their main strategy is to maintain the capital ratios which will help in improving their business and maximize the shareholder value. To maintain capital, they make changes in the dividends issued to shareholders or issue extra shares as an alternative. Their policy is to keep their gearing reduced by three times.

The company has secured loans in various countries in their local currencies to mitigate the FOREX risks and also to avail the tax benefits because of this the tax of the company has decreased to 3.1 from 4.5 million S$.

The cost of investment in the subsidiaries raised from 33.9 to 44.3 million S$ in the FY2013 and the investment in the subsidiaries has increased in the FY2013. This shows that the company has been investing more in expansion lately. They also provide loan to subsidiaries at an interest rate of 2.89% per year which is much unsecured as there is no terms or guarantee that the subsidiaries will repay the loan. In April 2012, they sold their associate company SRITP which generated sales revenue of $22 million. The operational cost of the company has also decreased in FY2013 due to a decrease in inventory levels.

As a strategy to maintain its assets the company anticipated the decreasing consumers, the rising unemployment rates in the European sector and has shifted its focus towards the distribution network in South East Asia. In order to strengthen their distribution network, they have widened their product range and secured more distribution rights from the suppliers due to their responsiveness towards the current trends. In addition to this, the company’s strategy is to enhance its development through the innovation of new products and secure the rising Vietnam and Thailand market as a substitute for the stabilized Chinese market.

Bibliography

C.Shapiro, A. (n.d.). Multinational financial management. In 9 (Ed.).

David k editeman, s. (n.d.). Multinational business finance. Pearson.

Dunlop. (2014). Retrieved March 27, 2014, from http://www.dunlop.eu/dunlop_euen/what_sets_dunlop_apart/technologies/

SGX. (n.d.). Annual Report stamford tyres. Retrieved March 22, 2014, from http://www.sgx.com/wps/portal/sgxweb/home/company_disclosure/annual_financial

Tyres, S. (2014). Retrieved March 27, 2014, from http://www.stamfordtyres.com/manufacturing/

No responses yet